Fundraise Faster, Part 3: Creating and Using Your Investor Target List

Mar 18, 2021

In Part Three of Fundraise Faster, Brett Brohl, MD of Techstars Farm to Fork Accelerator, explains explains how to make a target list of investors who are the best fit for your startup, and how to easily track your fundraising progress.

Fundraise Faster is a three-part series. Read and watch Part One and Part Two.

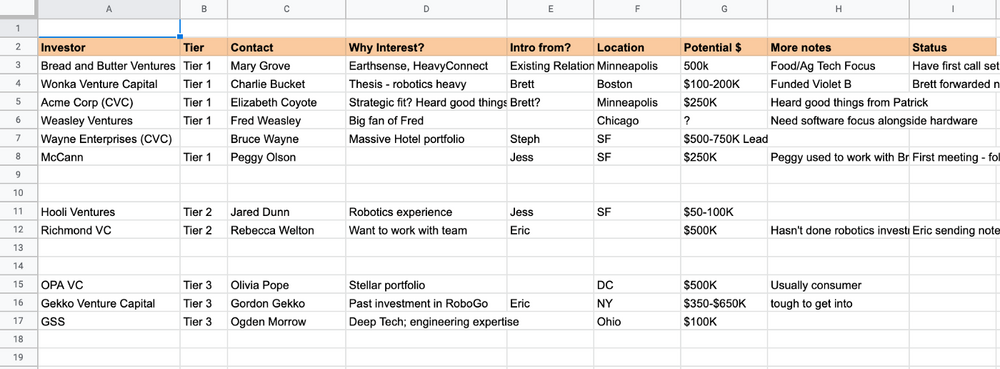

Prioritization and Personalization. These are two key concepts in Part 3 of Fundraise Faster. (Make sure you’ve read and watched Part 1 and Part 2). They are the two biggest reasons entrepreneurs should spend time putting together a target list of investors. It’s a pretty straightforward process — in fact, I’ve turned my simple format into a google sheet that you can use yourself by making a copy here: Fundraise Faster Target List

Let’s talk through why it’s important, and how to use it. I’ll also go through where this target list fits in the whole process in my video of Fundraise Faster Part 3, and I’ll dig in some more below.

First, doing research upfront is going to save you time in the long run. Why worry about pitching a firm that only invests in health care when you are a company focused on pest reduction robotics? Why spend time getting an intro to a firm that only invests in Series B when you’re just raising a seed round? A lack of focus in who you pitch not only wastes your time, it wastes warm intros. Entrepreneurship is all about prioritizing your time and being organized. Putting in the research upfront will help you do that. Spend the most time on your personal Tier 1 firms, then move on to Tier 2 and so forth.

Organizing what you know about individual firms and investors is also a great way to create personalized messages which makes it easier to ask for introductions, it shows you have done your homework, increases your chance at getting an intro and subsequently a meeting.

A bit more on setting up your sheet.

First up you’ll notice the division of funds into Tier 1, 2 and 3 investors. **An important note — these Tiers are not to be thought of in terms of how the market views an investor, instead it’s about tiering investors based on how they fit you/your company. **

Tier 1: These are your dream investors. They are a fit for both stage (seed) and sector (robotics). It includes people you’ve always wanted to work with or highly respect in your ecosystem. Spend the most time here, get personal and dig deep for intros. Network your way to these funds!

Tier 2: These firms may be a good stage/good sector fit, but for whatever reason might not be your dream (it’s not the blog you read every day). It is still worth a lot of work to get warm intros to these funds and personalize as much as you can.

Tier 3: This group tends to be filled with more generalist funds, funds you don’t know tons about, funds that might write smaller checks or don’t specifically call out your sector. They are less of a priority, still worth reaching out to but not worth as much effort to get to.

In addition to an organizational tool, use your list as a way to generate leads. A Google Sheet is shareable — share it with advisors, other founders you know, current investors and see if any of them can help make a connection at a fund. They can just put their name right in the column that says “Intro from?”

The third way to use this tool is simply for internal tracking. Keep a log of where you are in the investment process in that Status column (or add another column that works well for you). Has an intro been made? Have you met them? Do you need to send them more info? Are they interested but not a lead? Track your progress.

Fundraising is a slog uphill both ways. Put a process in place and do your research to save time and increase your chances of closing a round.

This article appeared originally on Medium.

About the Author

Brett Brohl

In addition to being the Managing Director of the Techstars Farm to Fork Accelerator, Brett Brohl is the Founder of Bread and Butter Ventures, an early stage venture capital fund. He is an experienced entrepreneur, investor, and mentor. He honed his startup skills as the CEO of multiple companies, leading three to exit. Brett publishes his tips and best practices for founders and investors on his YouTube channel, Brett’s Brain.