Why Every Startup Founder Needs a Company in an Investor-Friendly Jurisdiction

Aug 10, 2022

As a startup founder, sooner or later you will need to fundraise. One of the ways to minimize headaches and maximize your investor pool is to incorporate your topco, the company that sits at the top of your corporate structure, in a jurisdiction that recognizes and enforces the legal protections investors (like VCs) require.

As 2019 graduates of the Techstars Dubai program, Clara's team knows how to navigate the complexities involved in setting up and growing a startup. Clara has been working with Techstars to onboard incoming classes and form their topcos. By using a single platform to manage their legal needs, Techstars founders can take better care of the legal health of their company, manage their cap table and automatically generate key documents like SAFEs and Share Incentive Plans.

If your startup does not already operate within one, then you will need to set up a new company in an investor-friendly jurisdiction. This new company, which sits on top of your corporate structure, is now known as the "topco.” However, if your startup already operates in an investor-friendly jurisdiction, then it can act as your topco as it is.

At the end of the day, setting your business up this way means investors will be happy to invest in your startup and hold shares in your topco. It will also avoid you having to do any corporate restructuring, like setting up a new topco and doing share or asset transfers, to satisfy your investors and raise money later on.

What are investors looking for and why do I need a topco?

Investing comes with risk, which is why investors typically require several legal protections, including some that are specific to startups. This is why investors tend to favor startups incorporated in common law jurisdictions. These jurisdictions give investors the legal protections they need while providing greater flexibility for the company (like allowing for multiple classes of shares).

As a founder, having a topco in an investor-friendly jurisdiction has other benefits for you as well, as it can allow you to:

raise funds easily, by already being in a jurisdiction acceptable to most investors

issue convertibles like SAFEs, by being in a place that recognizes and enforces the right to turn convertibles into shares

protect your rights as a founder, by being in a place that recognizes share transfer restrictions and enforces vesting

have enforceable governance rights, by managing who sits on the board and creating voting thresholds

Topco best practices explained:

Topco only structure

Best for startups operating in an investor-friendly jurisdiction

If your startup already operates from an investor-friendly jurisdiction like Delaware, Singapore or the UK, then that operating company can also act as your topco. You will be able to receive investment, create share incentive plans (SIPs), and issue convertibles like SAFEs. But if your company is set up somewhere else, what do you do?

Topco and opco structure

Best for startups operating in a jurisdiction that is not investor-friendly

If your startup is not incorporated in an investor-friendly jurisdiction then you will need to create a topco that will own the shares of your company that actually operates your business (sometimes referred to as an opco). Convertibles, investments and incentive shares will be issued out of this topco. But all your operations (employees, commercial contracts, your lease, operating costs, revenue etc.) will remain at your opco.

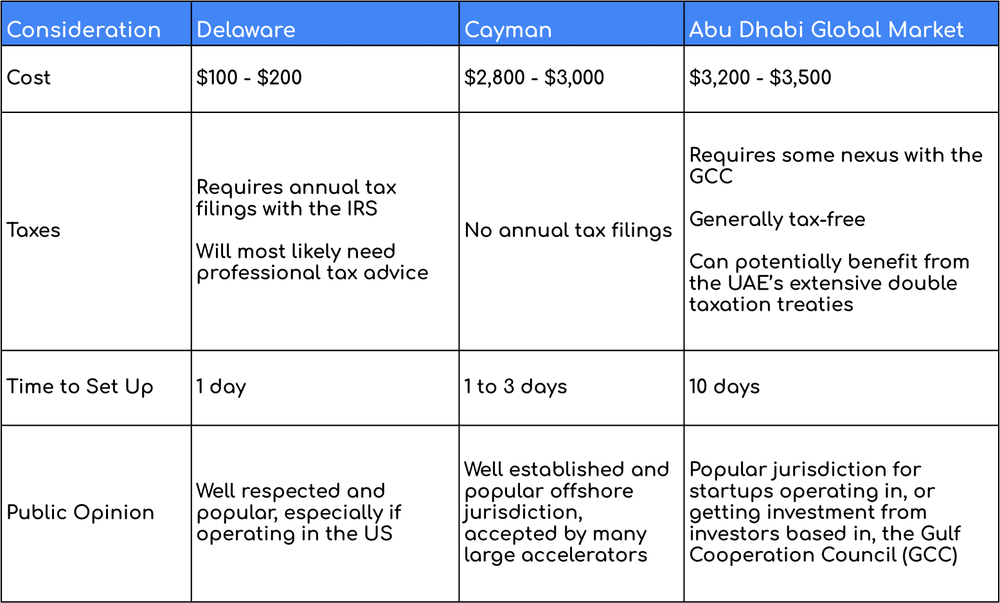

Where should I set up my topco?

Clara is a legal OS designed to help founders digitally form, manage, and scale their startups. From contracts to cap tables, Clara will find a way to help.

Disclaimer: the information in this article is provided for informational purposes only. You should not construe any such information as legal, tax, investment, trading, financial, or other advice.