Are Financings and M&A Slowing Down During the Pandemic?

Apr 25, 2020

By David Cohen, Techstars founder and Managing Partner

At Techstars, one of the most common questions we get is “How has the pandemic impacting financings and M&A transactions?” Due to the size of our system (now 2,200 accelerator portfolio companies and adding 500 per year) we have real-time insight into this question.

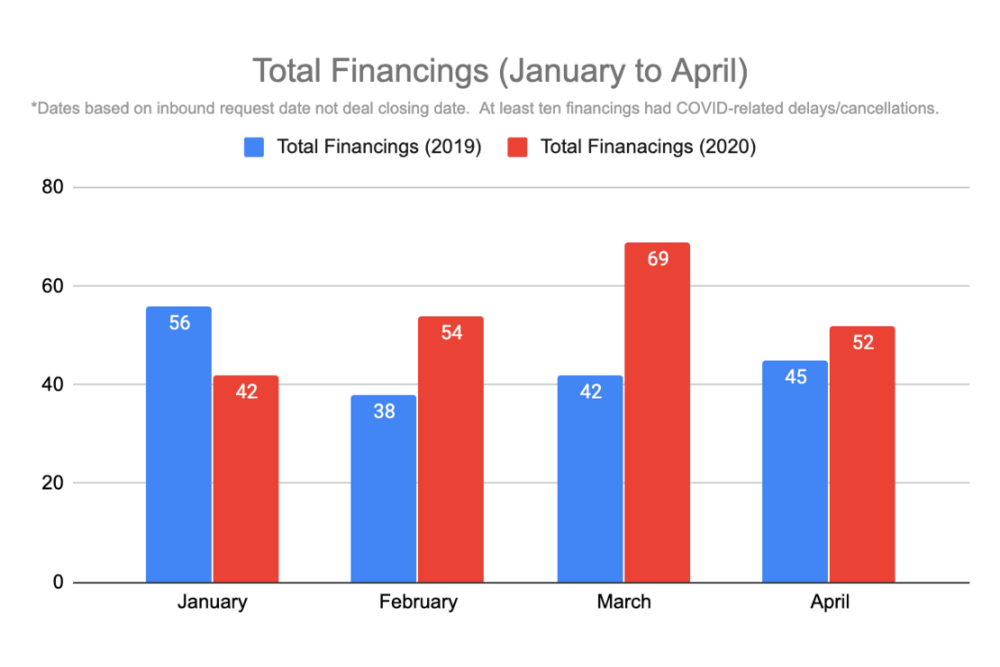

Each month we typically see between 40 and 70 financing events kick off, which is what we’re tracking here. Of the 217 financings started in the first few months of 2020 in our portfolio, at least ten of them were delayed or canceled due to COVID-19. As a percentage of those financings started in March and April, that is about 8%.

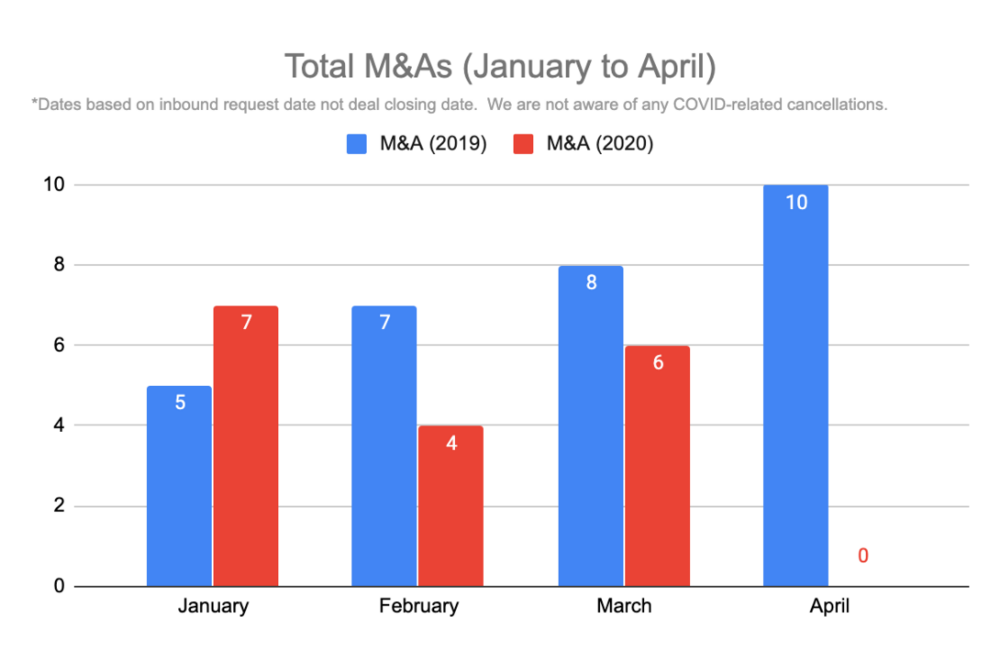

For M&A, we’re seeing something quite different. Generally, we see about 5-10 kick off per month in our portfolio at Techstars. It’s encouraging that we haven’t seen any deals canceled due to the pandemic yet, but I’m guessing we will. What is striking is that it goes to zero in April. Nobody is starting anything new, it appears. But they are working on deals that were in progress.

These graphs show data from only the global Techstars portfolio but it likely tracks closely to the general market. One thing to note is that the numbers are up overall over 2019, but our portfolio is also about 400 companies bigger than it was last year. The data is also not complete for April 2020 yet as of today.

I’ll try to update these views as time marches on.

This article originally appeared on David Cohen's blog.