How to Choose The Best Country for Registering Your Startup

Aug 18, 2022

Whether you've been dreaming of starting your own company for years or if the idea came to you in your sleep — like Mendeleev's periodic table — you need to wrap your business idea up in a secure legal structure. Once you have validated your business idea and concluded that it is commercially viable, it is time to register your business. The location–the jurisdiction–that you choose will have lasting impacts on your business, particularly when attracting clients and seeking external capital. Overlooking the importance of picking the right jurisdiction could land your business in trouble down the line.

Don’t listen to your friends or rely solely on internet forums–get legal advice from someone who knows startups inside-out.

When incorporating your startup, you have to analyze the following:

Where is your core market?

Who are your ideal investors, and where will you find them?

Where will your core team be located?

Today, it is possible to incorporate your business almost anywhere, and set up different elements of your business (founders, team, operational headquarters) in different places around the world. However, your business market, potential investors, and core team should all be established in strategically smart locations. If they are not, your cross-border business may suffer with its founding pillars fragmented across the globe. To prevent this from happening, here are some key questions to ask yourself when starting with the basic step of choosing a jurisdiction for incorporation.

What to consider when deciding which country to register your business:

Is your country of incorporation reputable (in the eyes of potential clients and business partners)?

Some customers and partners will have pre-requisites or preferences in place regarding the country where your business is incorporated. They may be deterred from doing business with you if your business is incorporated in a jurisdiction which has limited or unsuitable regulations (e.g. KYC, AML) in place. Will you need to think about creating additional legal entities in other countries to make conducting business easier? For example, if your main customers or partnerships are going to be in the EU, then it may be best to consider the EU countries as a location for incorporation. If instead, your clients are mostly located in the EU and your company is based in the US, issues may arise regarding GDPR (General Data Protection Regulation) and the handling of the data. The solution of having two companies, one based in the U.S. and one based in the EU may be required. It is also important to think about the location of your primary target market and your available market, and be sure to choose a country of incorporation that does not hinder attracting or doing business with your customers.

What kind of investors (and investor relationships) are you looking for?

Investing is based on trust, risk, and the overall relationship between the investor and the project they are investing in. If you are considering sourcing investments for your organization, and want to obtain outside capital, think hard about the type of investors you want to attract. Each angel investor or VC has their area of innovation they are most interested in: smartech; healthtech; edutech; traveltech; and the list goes on. Each investor will also have some geographical preference or areas of interest. Different jurisdictions will offer different methods of protecting their investments, as well as tax laws, legal frameworks, and costs applicable when investing. All investors from Singapore to Silicon Valley will be wary of protecting their assets, no matter their business interest or where they invest their money. Be sure to consider what type of investors you wish to work with in the future and where you're likely to find them.

Where are the key players (founders, team members, operational headquarters ) based?

It is important to figure out where your key stakeholders are going to be based. Where do the founders plan to be most of the time? Where should the operational headquarters be? Where is the best place to build a core team for the business? Where can talent be easily attracted and retained? A successful startup needs a team who enjoy a good quality of life and team-friendly governance, which is tied to the legal and business infrastructure where the team is organized and based. Your team may be spread across multiple jurisdictions or based in one location, either way, it’s important to consider things like compensation and tax preferences for founders, employees, and freelancers.

What are your startup's unique needs?

Every startup will be slightly different - what exactly does yours need to hit the ground running? A great starting point is to consider intellectual property rights and legal structures for tax optimization and effective corporate management. Now ask yourself, does the jurisdiction I want to register my company in serve these needs, or will it create barriers and unnecessary complications? Work out which countries have IP box regimes, are tax-friendly to your business, and will help ensure that your rights are protected both in the app store and in court.

Which jurisdictions are best for incorporating a startup?

You've covered your basics – customers, investors, team and business needs – but what else is there to consider? Here are five more things to consider when choosing the best jurisdiction for your startup:

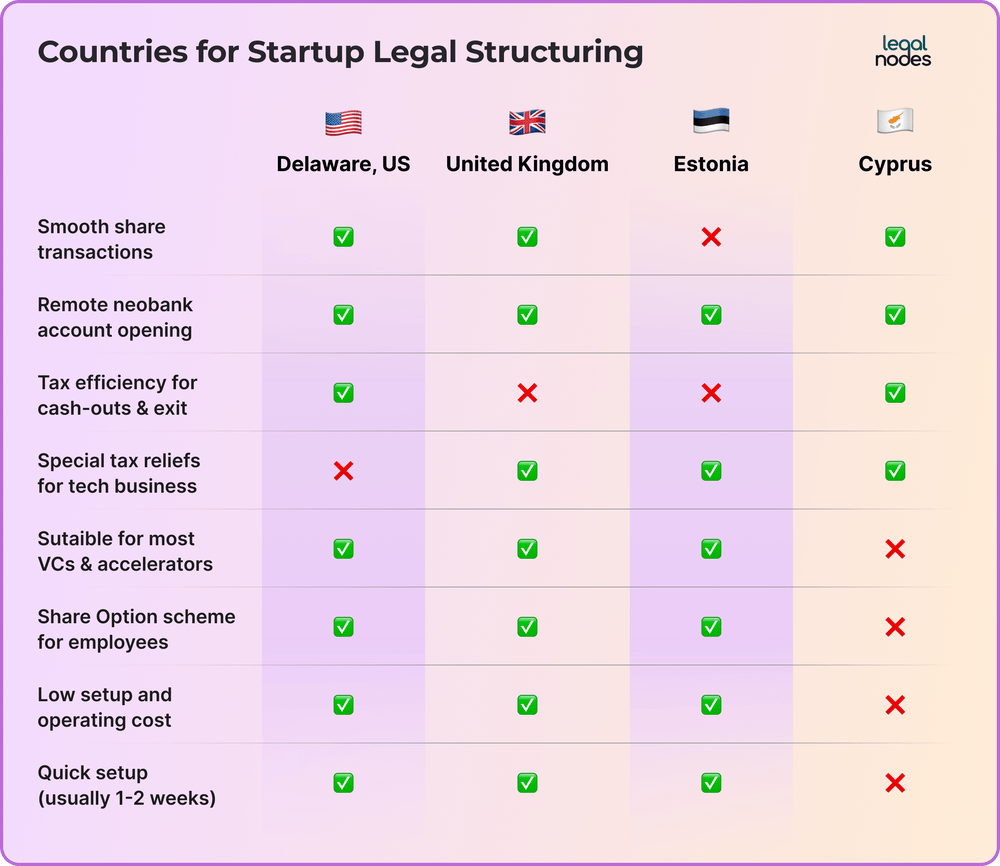

Whether share transactions (share issuance / secondary sales / reasonable KYC for shareholders) are likely to be smooth. In the UK, you can do almost any actions with your shares online and have the changes reflected in the registry within a couple of days (which unfortunately does not work in many European countries where all the documents should be submitted in person and translated into the local language).

Whether the operating cost can be reduced and accrued funds are enough for operations. Here, Cyprus allows various solutions to establish a business that meets the required level of substance recognized by the authorities, which allows applying relevant tax benefits. Many other EU countries provide virtual offices, accounting, etc. Cyprus, for example, accepts various forms of businesses, which, so long as they have enough economic presence to satisfy their minimum requirement, enable founders to enjoy certain tax benefits. Other benefits offered by other EU countries include the provision of virtual offices, accounting services, etc.

Whether opening and operating bank accounts is quick and easy or might take years. The recent growth in the number of UK fintech (neobanks and banking apps) has resulted in increased access to e-banking business solutions in this particular jurisdiction.

Whether tax and IP preferences are available for tech companies. From an IP (Intellectual Property) box regime in Cyprus and Research & Development tax relief in the UK to a special tax regime attracting tech companies to Estonia, different countries offer tax and IP schemes to make tech businesses feel comfortable.

Whether the country in question proposes additional benefits for the founders. For example, Estonia implemented an e-residence program, which allows obtaining such status in several days and registering a company promptly (and grants potential access to the Schengen Area).

Here is a table that compares some of the most popular jurisdictions for registering a startup.

Disclaimer: the information in this article is provided for informational purposes only. You should not construe any such information as legal, tax, investment, trading, financial, or other advice.

Author: Daria Zhuk, Head of Startup Legal, Legal Nodes

Daria knows the ins-and-outs of venture deals after working in the VC industry, and now she helps startup founders solve their complex legal issues, all via the Legal Nodes platform. When she's not out for a run or sailing on her favorite Platu25, you'll likely find her discussing the best ways to structure a deal with her clients.