A Beginner’s Guide to Revenue Formulas

Apr 15, 2024

By Steven Plappert, Co-Founder & CEO of Forecastr (Techstars 2020)

Today, we’re digging into one of the most important tools in the founder toolkit — your revenue formula. I’m going to guide you through understanding what a revenue formula is, what makes it useful, and how it will help you forecast (and hit) your revenue goals.

What Is a Revenue Formula?

The ability to generate (lots of) revenue is the lifeblood of every successful startup. A revenue formula is simply a math equation that outlines how your company makes money. It answers questions like how you acquire customers, and how you turn those customers into dollars, and sheds light on the metrics & KPIs that drive those aspects of your business model.

There are four core components that are present in every revenue formula, yours included, each answering one of these critical questions regarding how your “money machine” works:

Lead Generation: How do you generate leads?

Metrics include: lead volume by channel, growth rate by channel, etc.

Customer Acquisition: How do you acquire customers?

Metrics include: conversion rate by channel, demo requests, new customer counts, etc.

Pricing: How do you turn those customers into dollars?

Metrics include: Avg. revenue per user, Avg. order volume, Avg. contract value, etc.

Customer Retention: How do you turn those dollars into more dollars?

Metrics include: churn rate, upgrade rate, repeat purchase rate, order growth rate, etc.

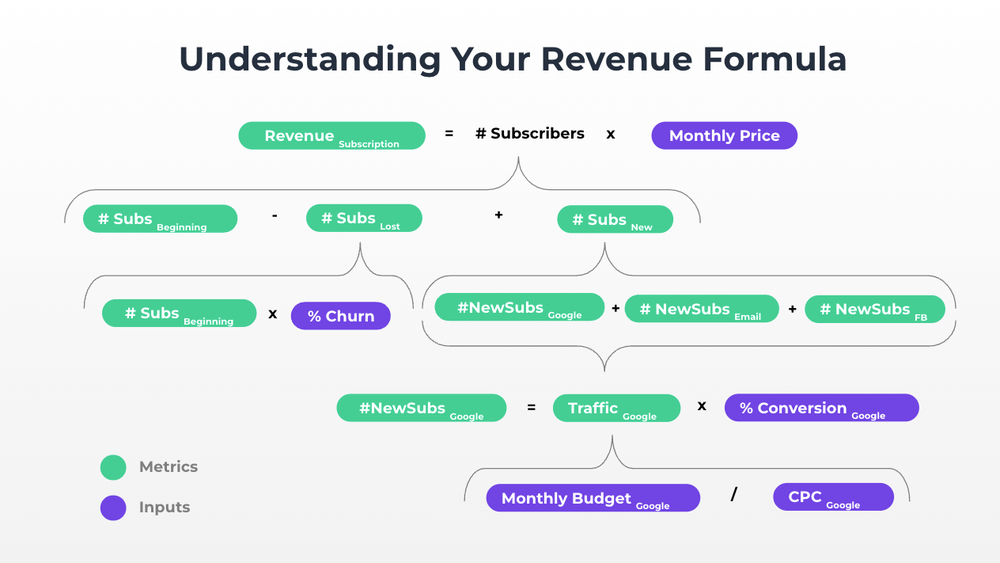

In its most basic form, the revenue formula (for a subscription SaaS company) is stated as:

Revenue = Subscribers X Monthly Price

In practice, it looks more like this:

Why Your Revenue Formula Matters

Understanding your revenue formula isn’t just important — it’s mission-critical. Running out of cash is the most common reason businesses fail, but that’s just the symptom, not the root cause. The reason these companies run out of money is because they fail to generate significant revenue, quickly enough, to attract new investment or turn a profit.

You cannot (legally) force anyone to buy your product. You have to earn your revenue, you have to create value for the market.

The #1 thing you can do to take control of your growth and drive more revenue, is to understand your revenue formula and the metrics & KPIs that drive your revenue engine.

When you understand your revenue formula, you know which metrics drive the most revenue growth for your company, and matter most. From there, you can create laser-focus on those metrics, watch them like a hawk, and run iterative experiments to optimize them over time, building a better business. Understand these metrics and KPIs, and do everything in your power to drive them as aggressively as possible.

As a bonus, investors love it when a founder knows their revenue formula. They love to see that you know your numbers, have a plan for improving your KPIs over time, and know which of them matters most.

What Makes a Good Revenue Formula?

No matter what type of business you run, your revenue formula has the following four core components. I mentioned these above, and I’ll go into more depth here.

Lead Generation: All customers start off as leads. How do you generate leads? How do your potential customers become aware of your products and services? What channels do you use? How do they work? A good revenue formula spells out the mechanics for how leads are generated through your different customer acquisition channels. Think this through for your business, ask yourself these questions, and see if you can describe the behavior using math.

Customer Acquisition: Once leads enter your funnel, the next step is to convert them into customers. How does that happen? Do you have multiple types of customers going through different conversion processes, or is everyone treated the same? What steps do leads take to become customers? Does it happen self-serve? Do they talk to a sales rep? Does it happen all-at-once, or over multiple months? A good revenue formula represents the process leads go through to become customers, and describes that process with conversion metrics.

Pricing: Once you acquire a customer, they need to pay you something for you to generate revenue. How does that happen? What do they pay you? Is it one-time or recurring? Do you have one product, or lots of different options? A good revenue formula describes how customers pay you money and generate revenue for your business, as well as the metrics & KPIs that drive that monetization process.

Retention: Once a customer pays you (once), how do they continue to pay you more money over time so you can maximize their lifetime value? Do you have to upsell them on another product? Did they purchase a subscription that recurs monthly or annually? Do you try to get them to order more product over time? How often do they come back? A good revenue formula showcases your retention mechanisms, and shows you, and your investors, the metrics & KPIs that drive your customer lifetime value.

There you have it folks! Those are the basics when it comes to revenue formulas.

In our next post, I’ll walk you through the process of building a detailed revenue formula for YOUR business, and show you some examples.

Want an expert to do this for you? I thought you’d never ask!

Click here to schedule time with a modeling specialist at Forecastr today!

About the Author

Forecastr

Forecastr is an out-of-the-box finance function for your business. We provide the tools and support you need to create an investor-grade financial model. Learn more at forecastr.co.