How Are Startup Financings and M&A Impacted by the Pandemic? (through Oct 2020)

Nov 06, 2020

By David Cohen, Techstars founder and Managing Partner

Back in April of this year I wrote “Are financings and M&A slowing down during the pandemic?” with the goal of sharing the Techstars view of how things have been changing given the events of 2020. Here’s an update to that data through the end of October, 2020. Remember, the graphs show when the activity starts (comes across our virtual “desk” at Techstars for the first time). I’ll continue to try to update and share it as we get more information.

Read about a founder's experience raising a round during the first wave of the pandemic

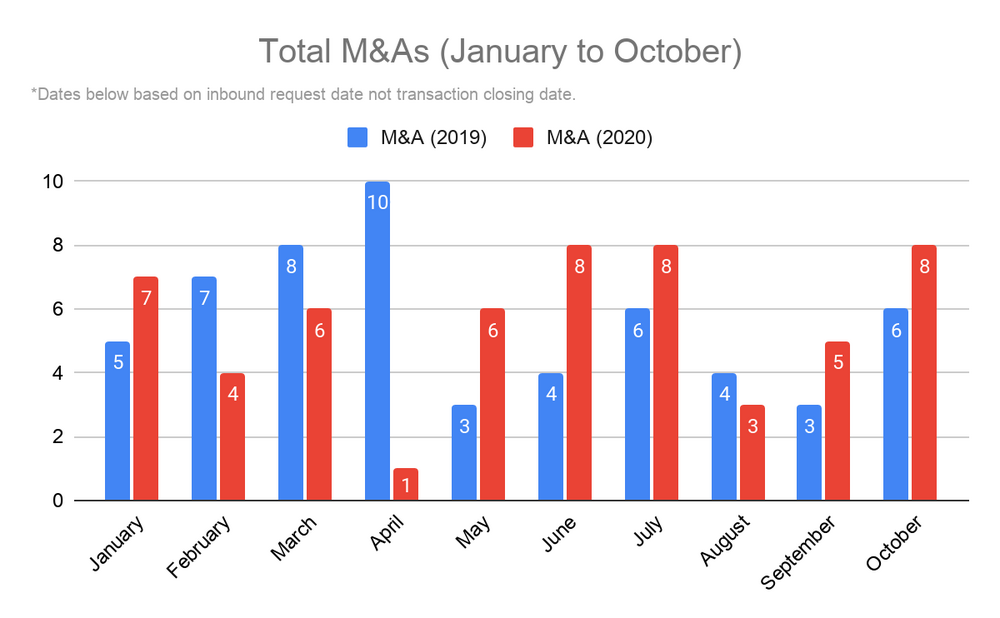

Total M&As YTD

2019: 56

2020: 56

The M&A data implies that the market “flinched” in April 2020. The one data point we saw in April 2020 was near the end of that month. Almost nobody was starting new M&A transactions in April. But, as the stock market came back so did the acquirers, just as quickly. My take on this is that the experienced acquirers are now deal hunting or doing business as usual. Those that are less experienced are still on the sidelines. Now, in October, M&A is really up but some of this activity is in smaller deals. As some startups have realized that they can’t raise a new round and continue to go it on their own in some cases, perhaps acquirers are being more opportunistic?

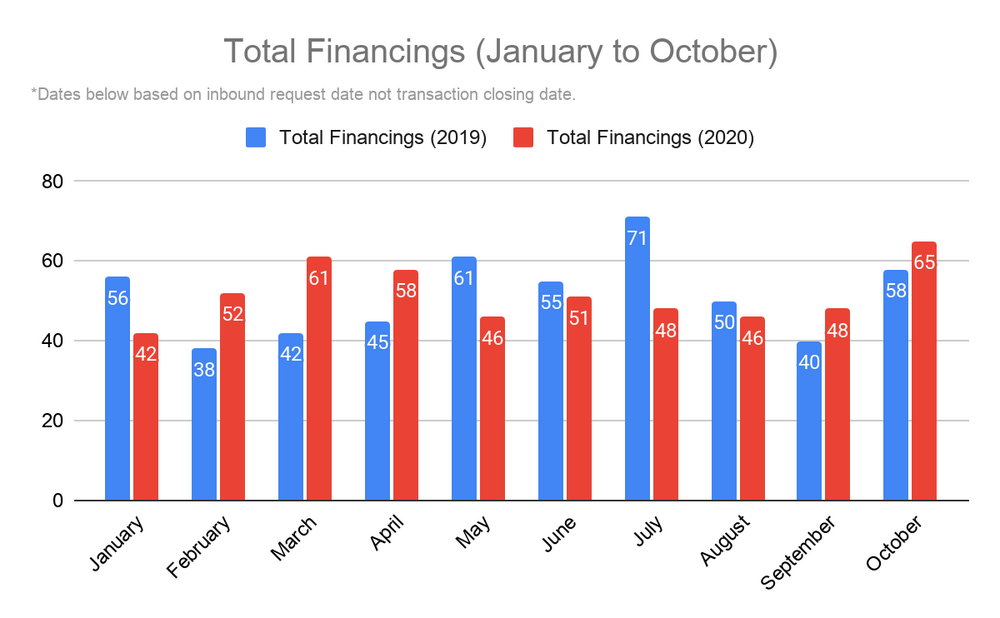

Total Financing YTD

2019: 516

2020: 517

For financings, the data shows that there’s still no meaningful change in the activity level in general. Last July was a bit of an outlier for Techstars, with 71 financings starting that month. This was a high for the year (2019) up to that point. In 2020, we’re seeing financings continue on relatively the same pace as last year, adjusted up slightly for the size of our portfolio growing at about 500 companies per year which is about 20% over 2019 data. Takeaway: VCs have capital and they’re deploying it. Sure, maybe valuations have adjusted downward slightly, but the pace feels unchanged or even slightly up from our early stage perspective.

Read David's first update from July 2020. This article originally appeared on David Cohen's blog.